Take Control of Your Household Expenses with a Budget BillPay Account.

Say goodbye to bill stress! With a Dubco Ireland Budget BillPay Account, your recurring annual expenses are managed effortlessly—so you never miss a payment again.

Managing your money doesn't have to be overwhelming. At Dubco Ireland, we’re here to support our members with simple, practical tools and advice to help you stay in control of your budget and avoid financial stress.

3 Simple Steps to Manage Your Money Effectively

- List All of Your Expenses

Start by writing down your regular and annual outgoings, including:- Mortgage or rent

- Utility bills (gas, electricity, broadband, etc.)

- Loan and credit card repayments

- Subscriptions and insurance

- Transport and childcare

- Record Your Income and Savings

Include all sources of net income (after tax) and any savings or investment income.

Top Tip: If you're carrying a balance on your credit card, it could be costing you more than you think. Speak to Dubco Ireland today about how we can help you reduce or consolidate debt with lower-cost options. - Create Your Budget

Subtract your total expenses from your income. The money left over is your discretionary spending budget for groceries, clothes, entertainment, holidays, and emergencies.

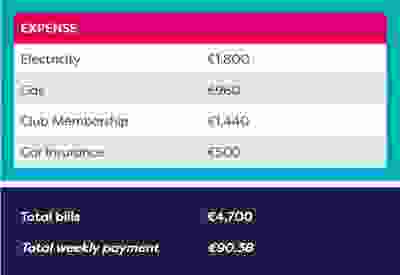

Budgeting Tip: Use your most recent bills or bank statements to accurately estimate your monthly spending. Our Budget Calculator makes this step even easier, view your bills by category and calculate your weekly payment plan.

If you’re worried about making ends meet or falling behind on repayments, don’t wait, get in touch with us today. We're here to:

- Help restructure your loan repayments

- Offer budgeting support through our Budget BillPay Account

- Guide you toward support services like MABS or Citizens Information

Call us on 01 887 0400 to speak with a friendly member of our team.

Plan for Future Expenses

Use past bills to estimate your future costs. Example: If your car insurance was €600 last year and you expect a 25% increase, budget €750 this year.

Money-Saving Tip: Shop around for the best deals on utilities, insurance, and services—switching providers can often save you money.

Don’t Ignore the Signs

If your expenses exceed your income:

- Reduce non-essential spending

- Re-evaluate monthly subscriptions

- Increase income where possible (check for tax reliefs or social welfare entitlements)

Make Sure You’re Getting All Entitlements

You may be eligible for tax credits, social welfare payments, or other government supports. Check:

Prioritise Debts

Focus on essential debts like mortgage or rent, utilities, and any loan repayments. These are critical to your financial wellbeing and credit record.

Communicate Early and Often

Don’t ignore letters, emails, or calls from creditors. Avoiding contact can harm your credit score and may lead to legal action. Always address financial issues head-on—and remember, Dubco Ireland is here to help.

Ready to Talk?

If you're experiencing financial difficulty or would like budgeting support, call us today. Our dedicated team will work with you to find the best solution.

Contact Dubco Ireland on 01 887 0400

Send us a message

Or visit our branch